PROJECT SCOPE

• Shop Online New York

• Date: September 12, 2024 - January 3, 2025

• Duration: 4 months

• My Role: UX Researcher/Co-Lead

• Methodology: Surveys, User Interviews, SWOT Analysis, Heuristic Evaluations

• Tools: Zoom, Figma, Excel

RESEARCH OBJECTIVE

• Shop Online New York (SONNY) is an e-commerce platform targeted towards people exclusively within New York State.

• SONNY also stands for “Support Our Neighborhood Networks”.

• In accordance with the vision of our CEO and product owners, the purpose of SONNY is to connect New Yorkers on a platform that is worker driven, socially minded, and sells local products that New Yorkers are interested in.

WHAT WAS THE PROBLEM?

• SONNY, in contrast to its competitors, was very much in its infancy.

• In addition, any user research data that was gathered prior to my cohort entering the team had been wiped out due to an accident with the drive.

• This meant that I, as well as my new peers had to gather primary and secondary research from scratch, as we no longer had any preliminary insights to work off of.

HOW MIGHT WE. . .

• Gather new and insightful data that addresses the needs of our target audience?

• Develop an e-commerce platform that effectively serves consumers across New York State?

COMPETITOR ANALYSIS

• Our competitor analysis was crucial for understanding gaps in the market and what our target audience might be interested in.

• As we were developing our product, the analysis showcased different features and services that could be quite beneficial to our users.

• These features include having a large selection of various products, clear product descriptions with images, as well as competitive pricing.

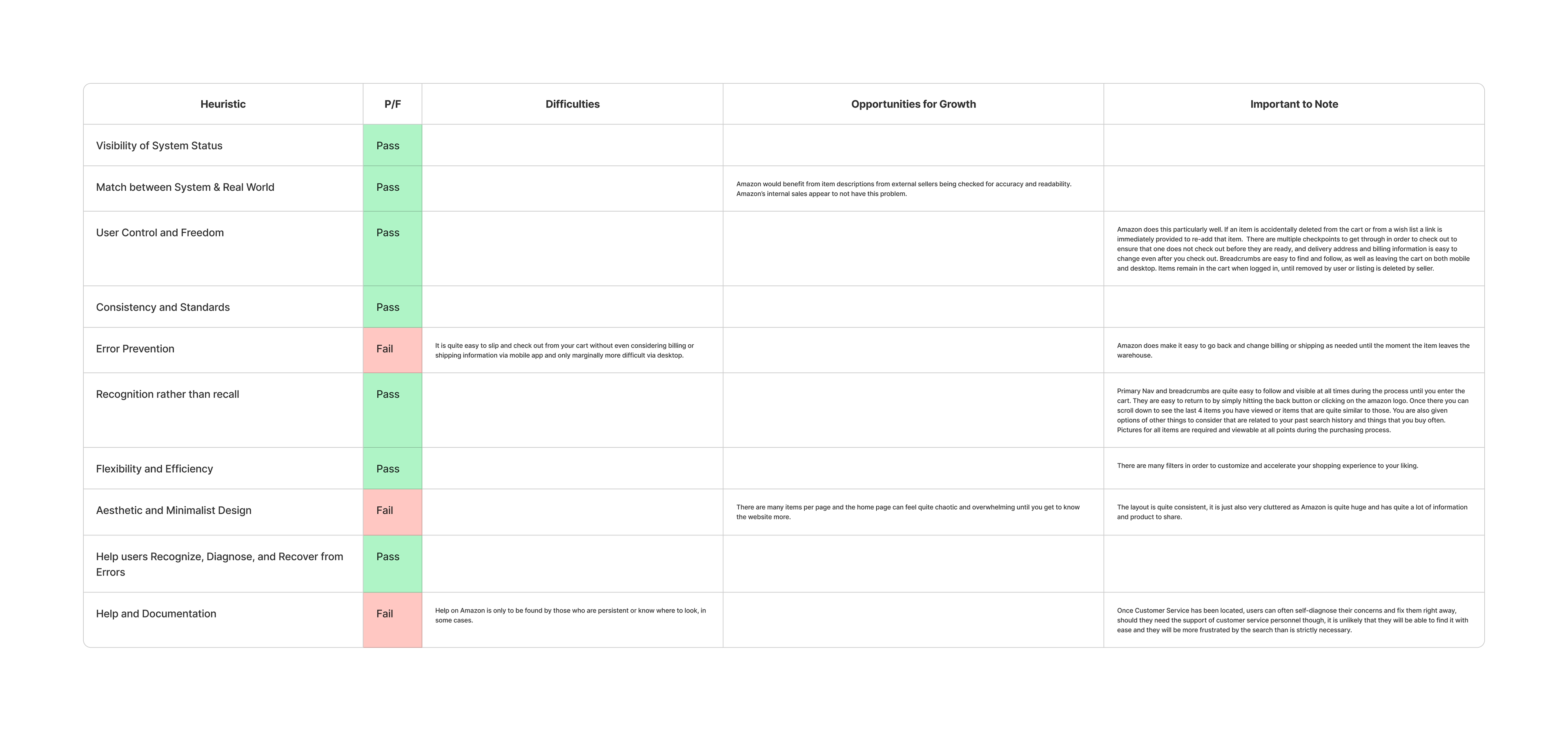

HEURISTIC EVALUATIONS

• We conducted our evaluations on the platforms Amazon, Wayfair, and Alibaba.

• The categories that our participants had the most trouble with were control and freedom, visibility of system status, and recognition rather than recall.

• As a result, it was integral that we include options that:

• Give the user autonomy, such as a "Back" or "Most Popular" option.

• Let users know an item's inventory status (e.g., "only 3 left in stock").

• Providing a [ ? ] link around certain categories for explanations.

Amazon

Wayfair

Alibaba

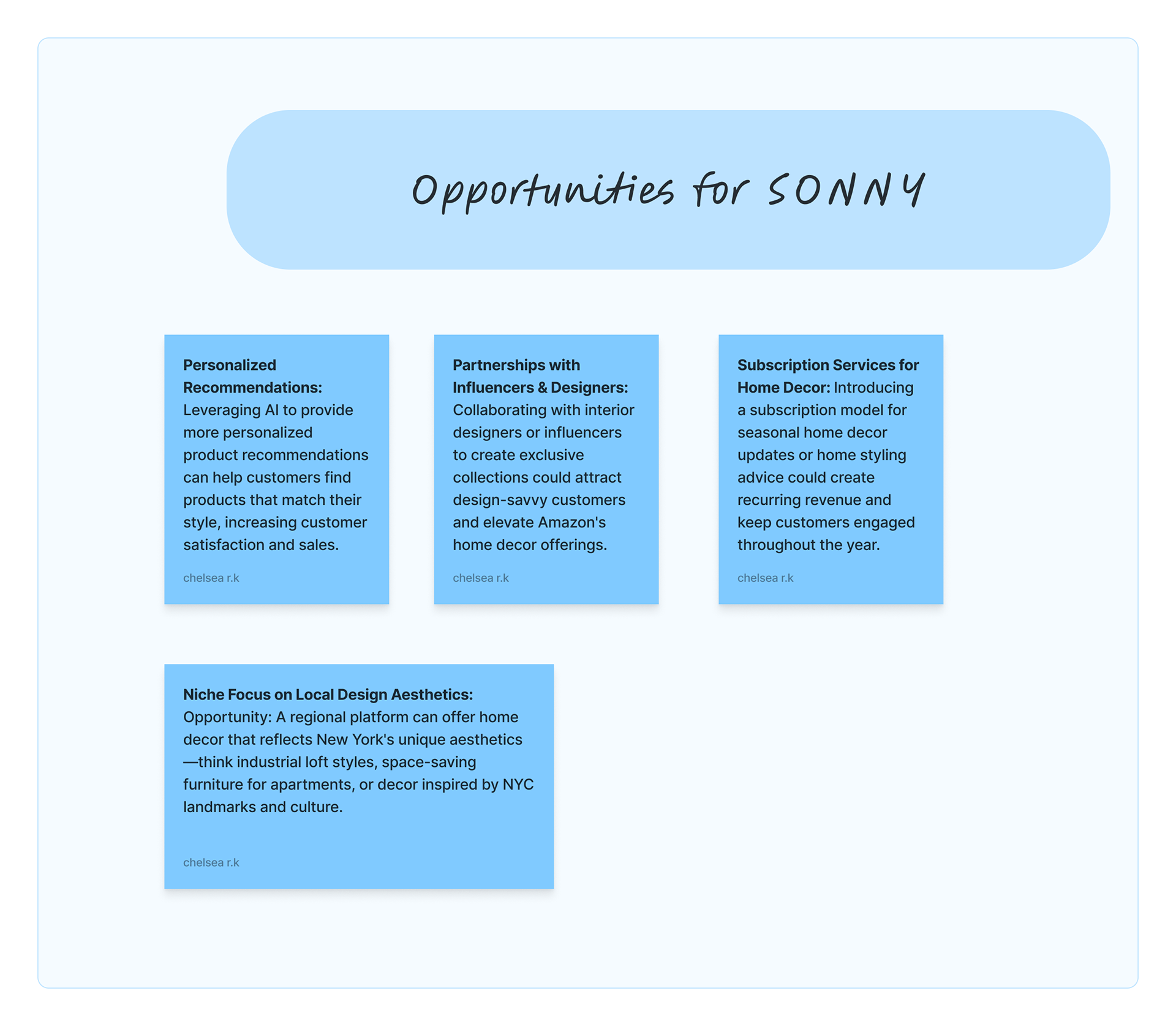

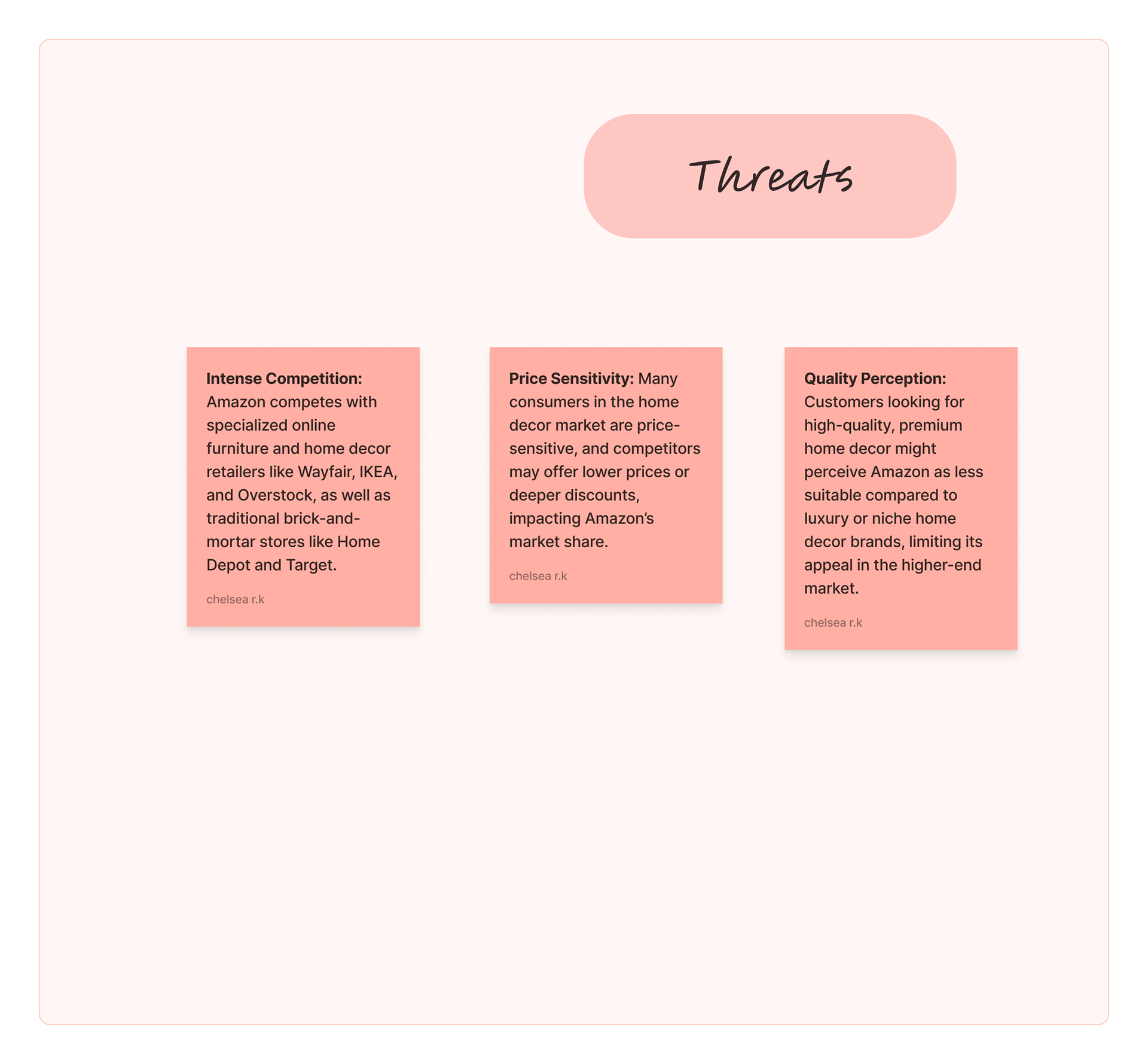

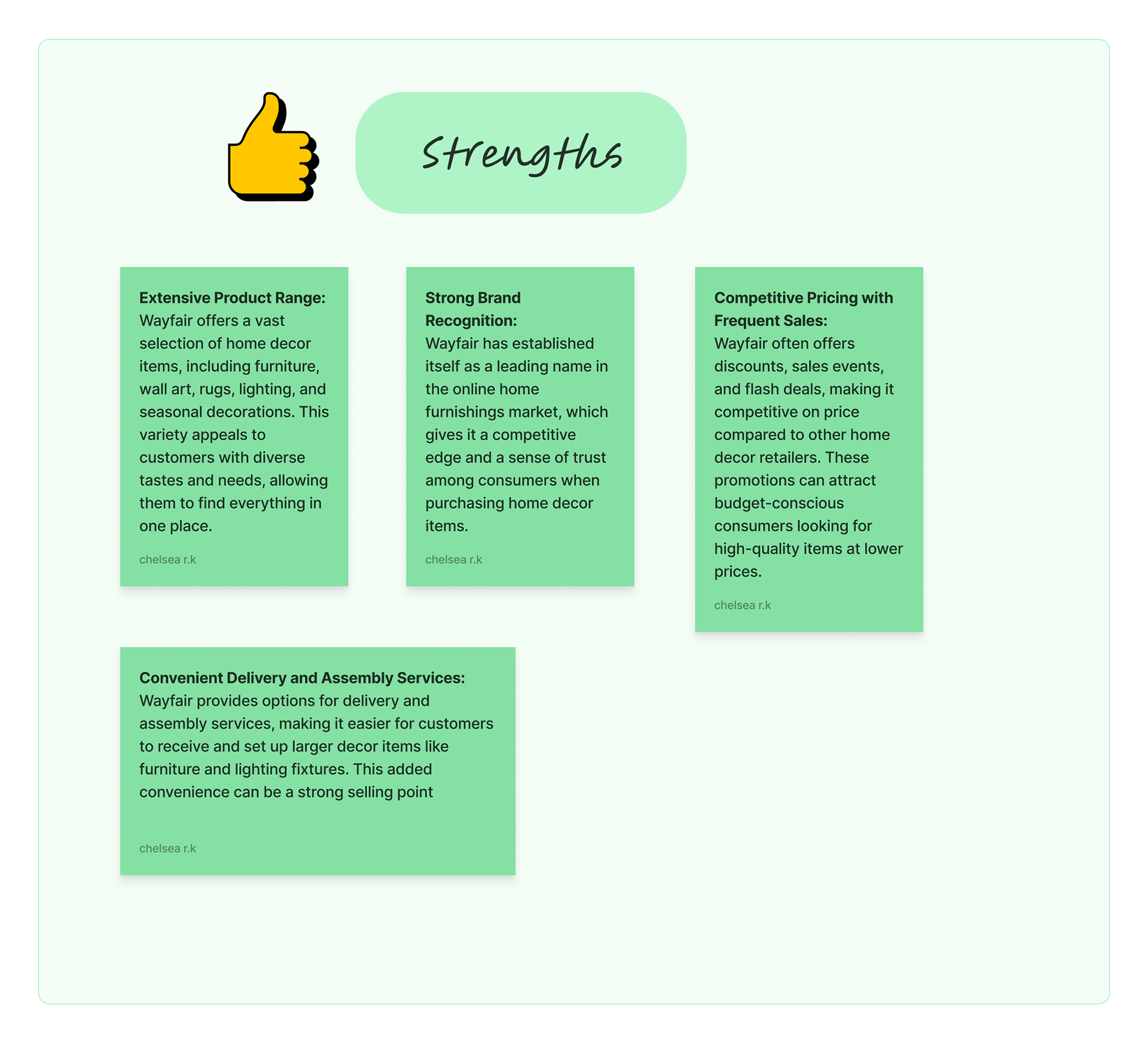

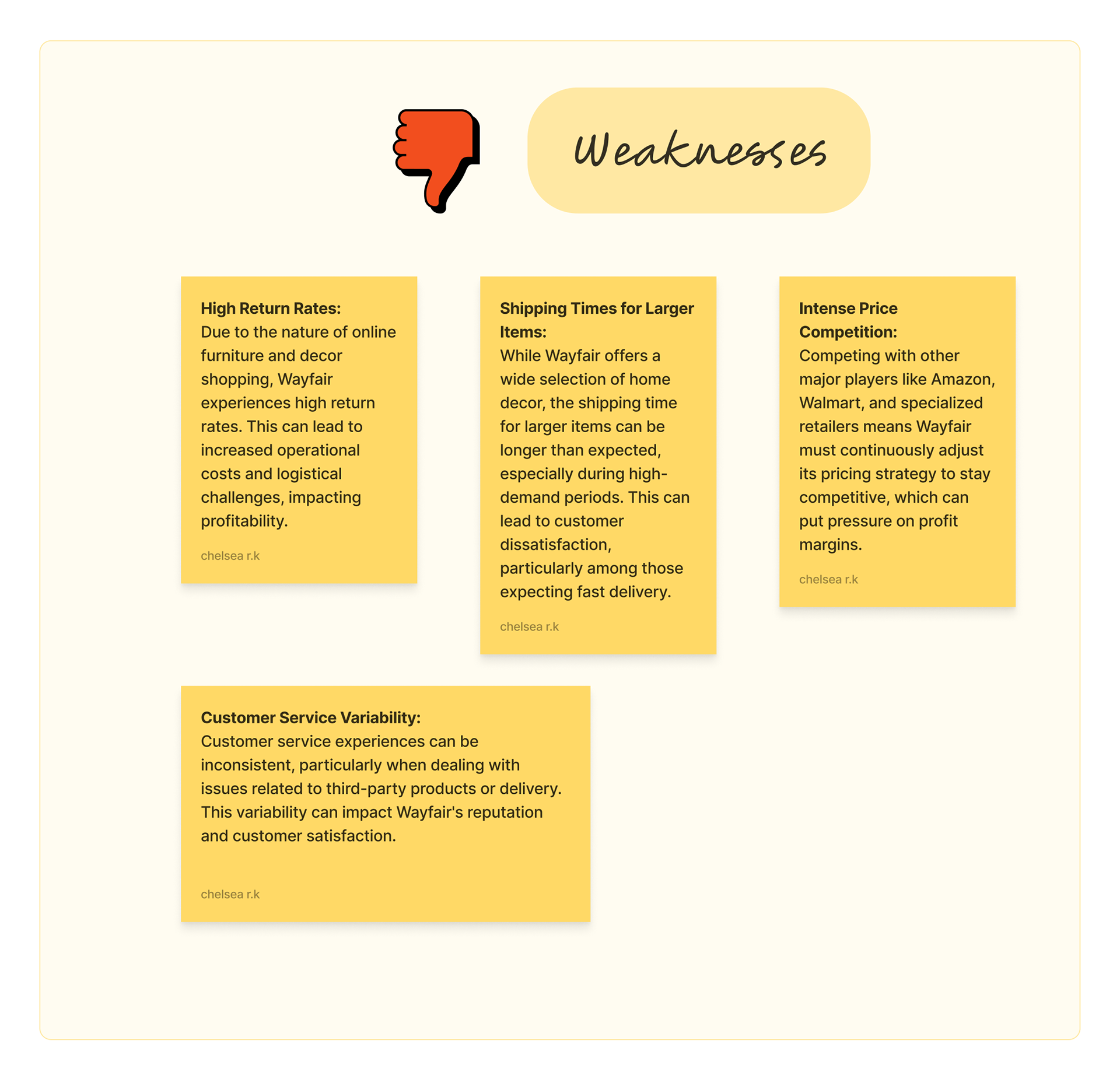

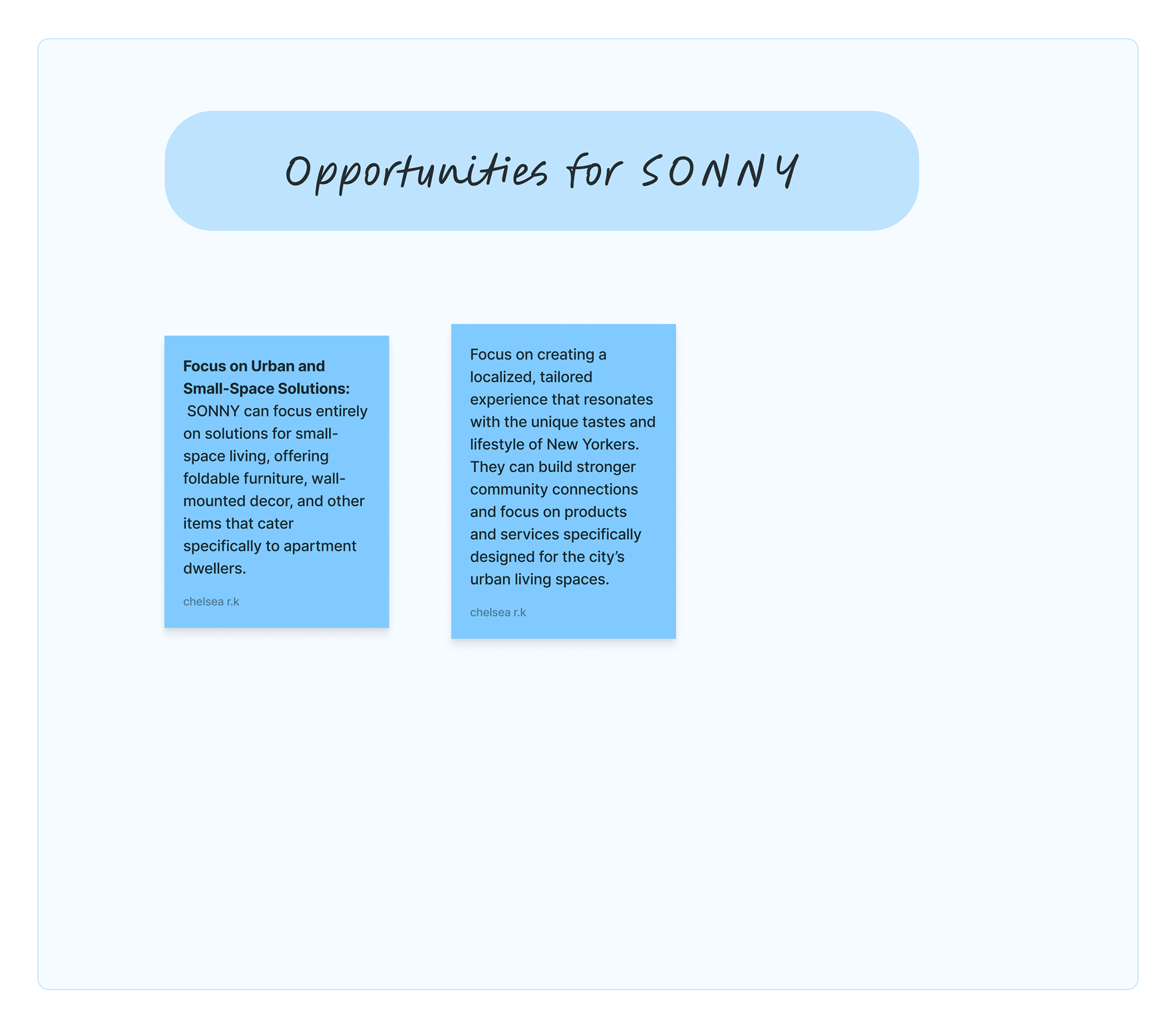

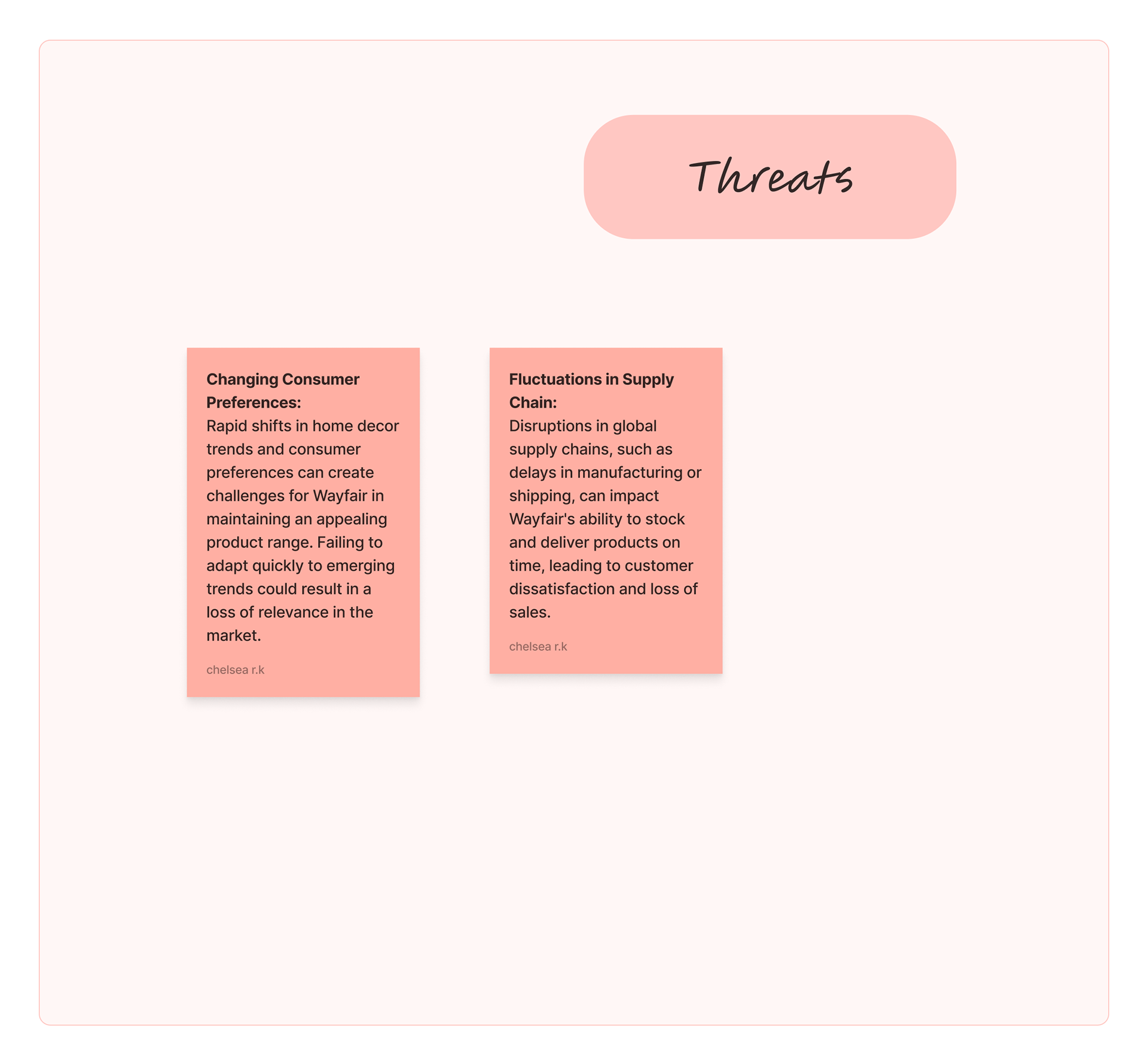

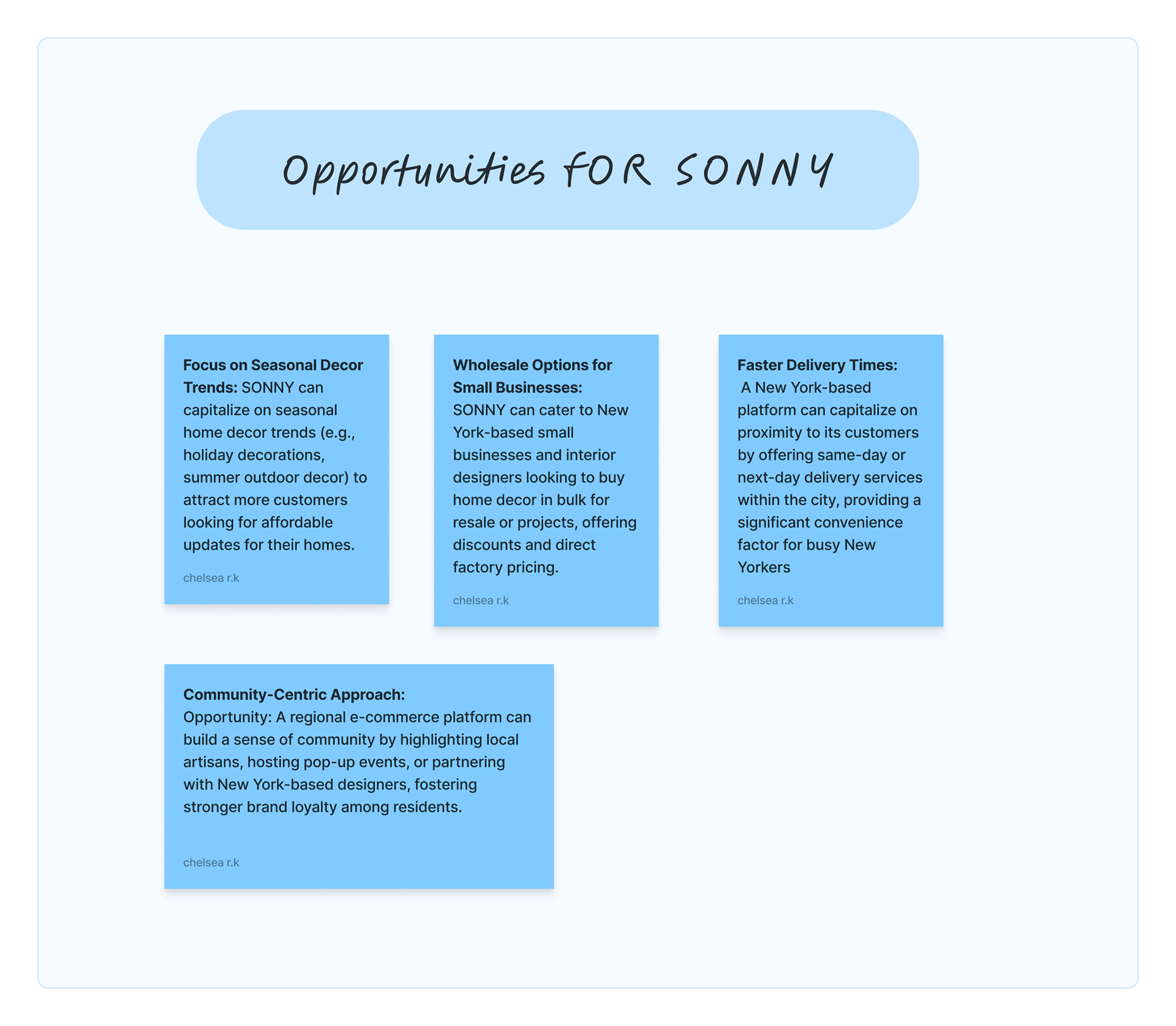

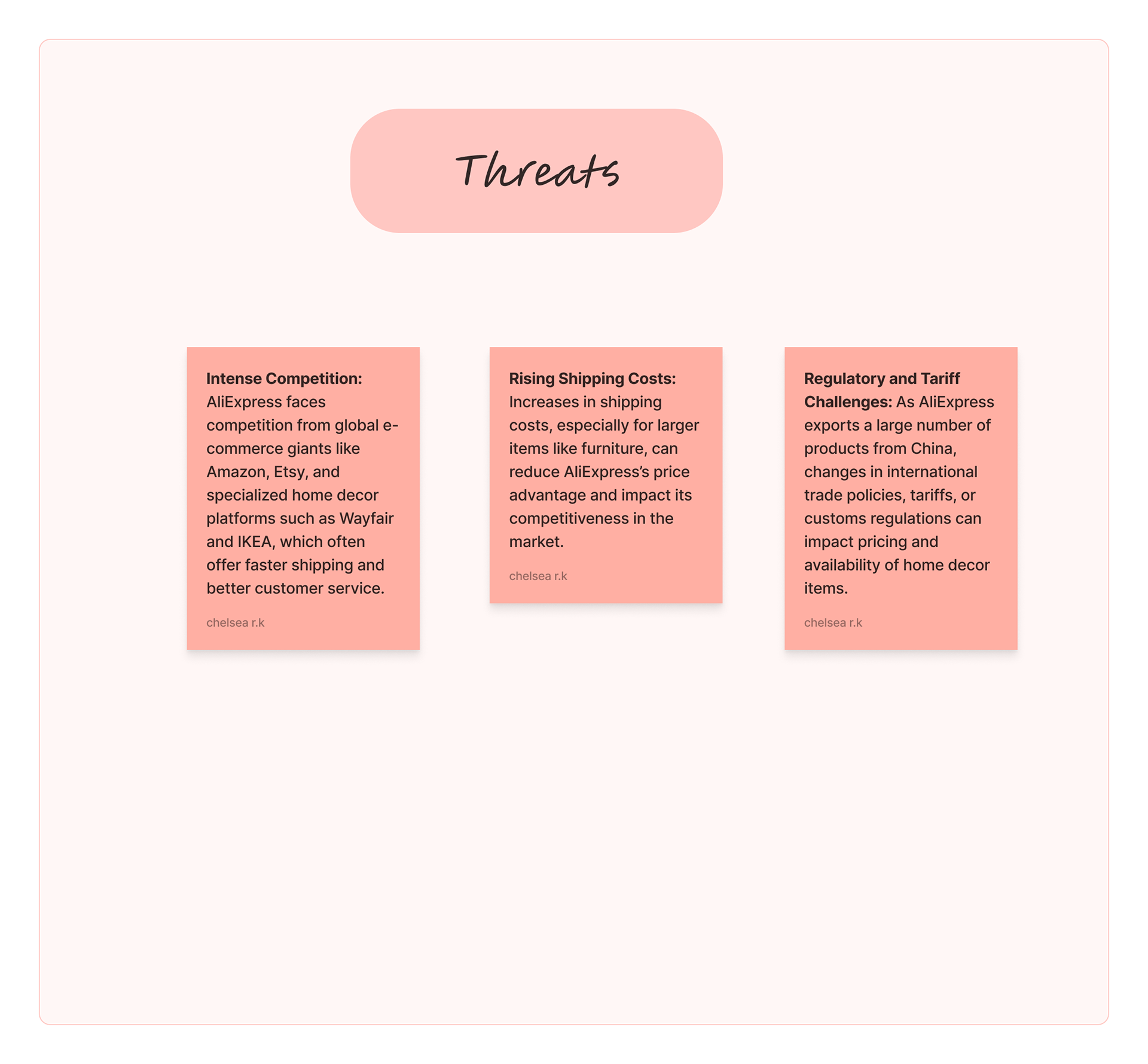

SWOT ANALYSIS

• In conjunction with our previous tasks, we wanted to outline how the strengths and weaknesses of our competitors can be used to understand our target audience as an up-and-coming platform.

• For example, common flaws among the services that we analyzed were:

• Inconsistencies with customer service.

• Variation in product quality.

• Certain platforms being too niche or not niche enough.

• We then used these findings to highlight our opportunities for growth.

Amazon

Amazon

Amazon

Amazon

Wayfair

Wayfair

Wayfair

Wayfair

AliExpress

AliExpress

AliExpress

AliExpress

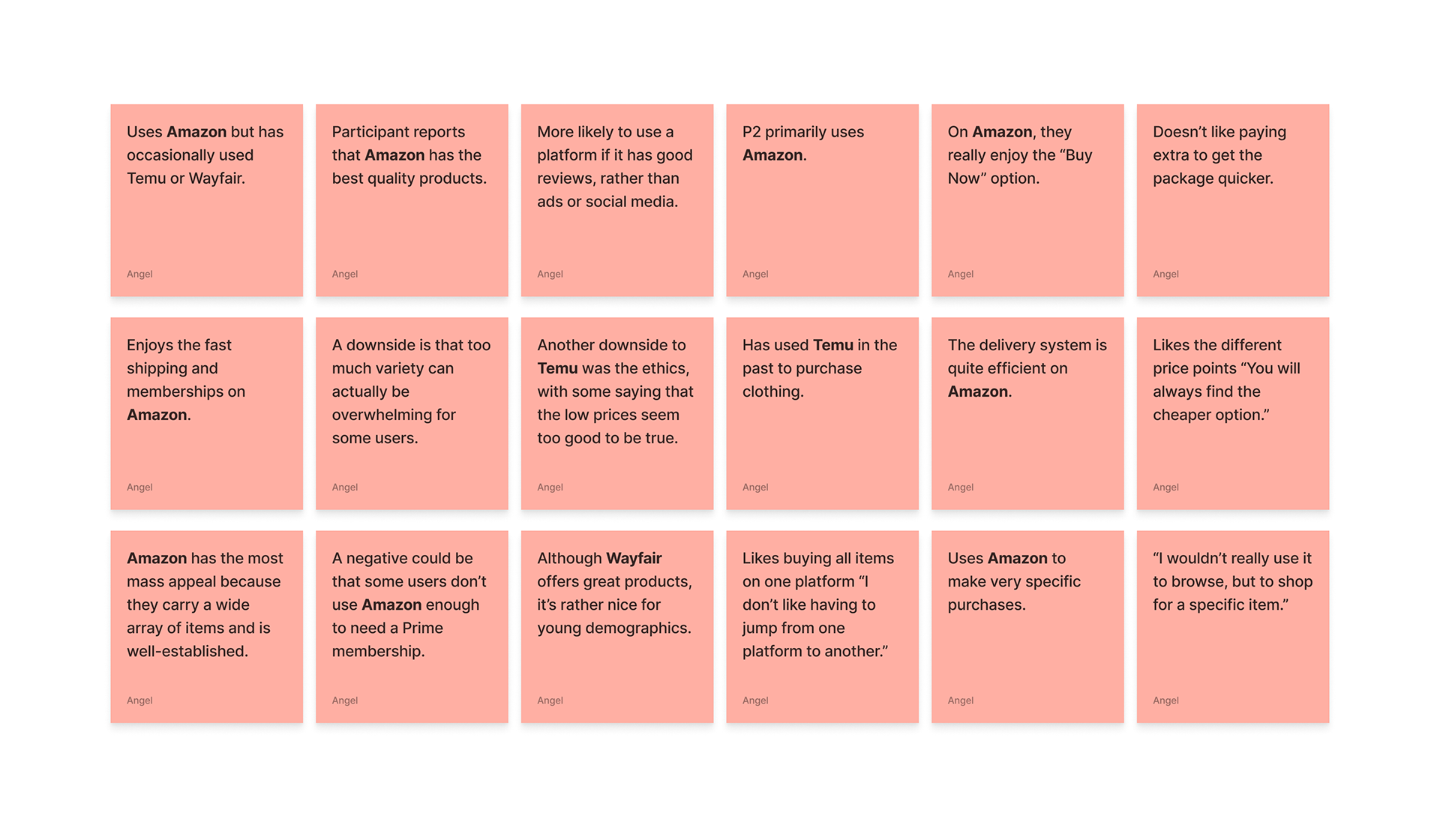

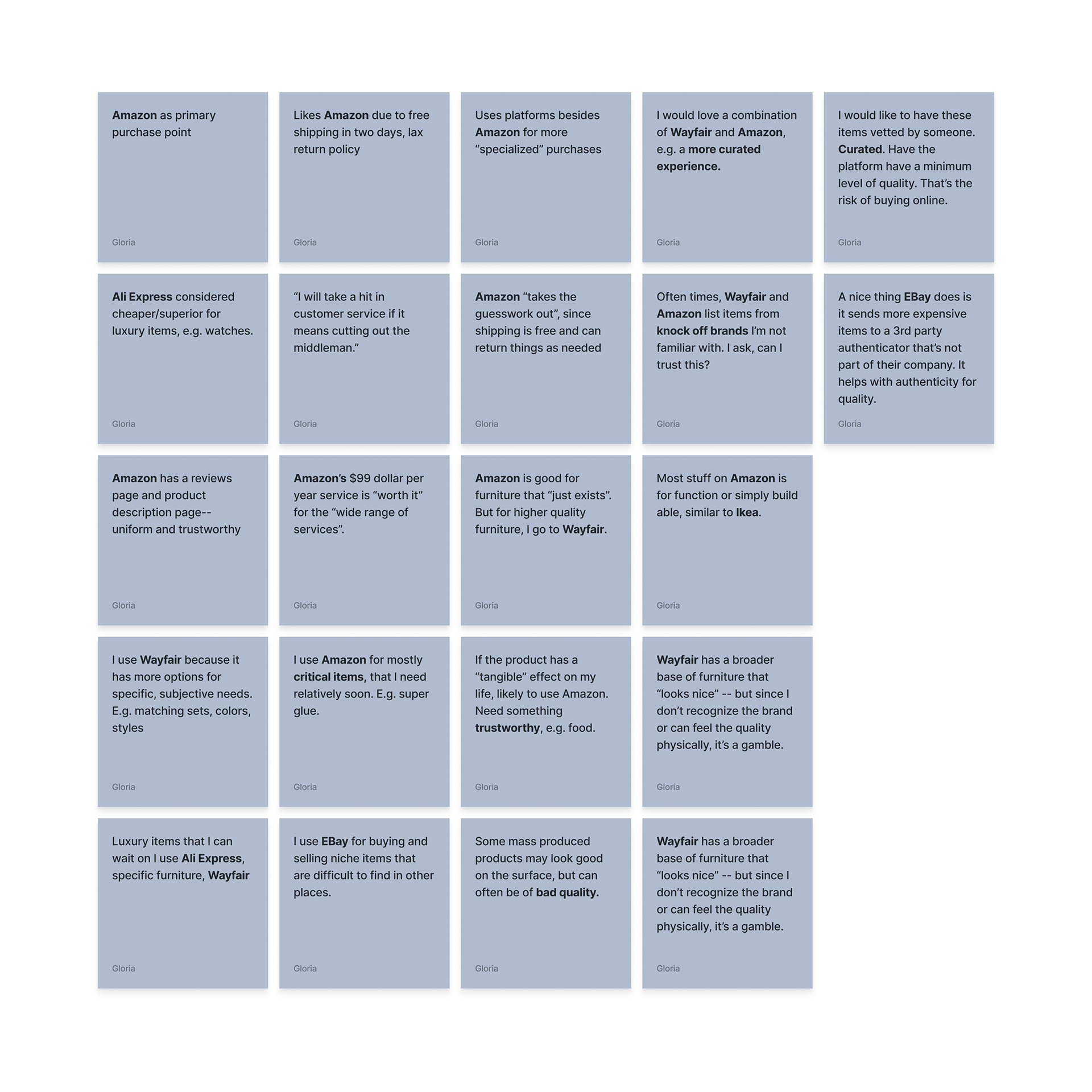

SURVEYS & USER INTERVIEWS

• My team and I interviewed 10 participants regarding their experiences with online shopping platforms.

• Our users revealed their e-commerce preferences and concerns, which was useful for piveting our marketing and product development strategies.

• Some of these metrics included:

• How often our users purchased from various e-commerce sites.

• What were their pain points?

• Which aspects or features our users prioritize most in their online shopping experiences.

• What would persuade users to start using another platform?

WHAT WERE THE FINDINGS?

• My team and I found that:

• A vast majority of our users primarily used Amazon, but some occasionally used Wayfair or Temu.

• Our participants generally browsed their preferred shopping platforms 1-2 times per week, and made a purchase every 2-3 weeks.

• Users were generally frustrated when the quality did not hold up or when there were too many options to the point it felt overwhelming.

• They would be more inclined to use a platform such as Wayfair or Temu if there was more advertisement or if they offered discounts or memberships.

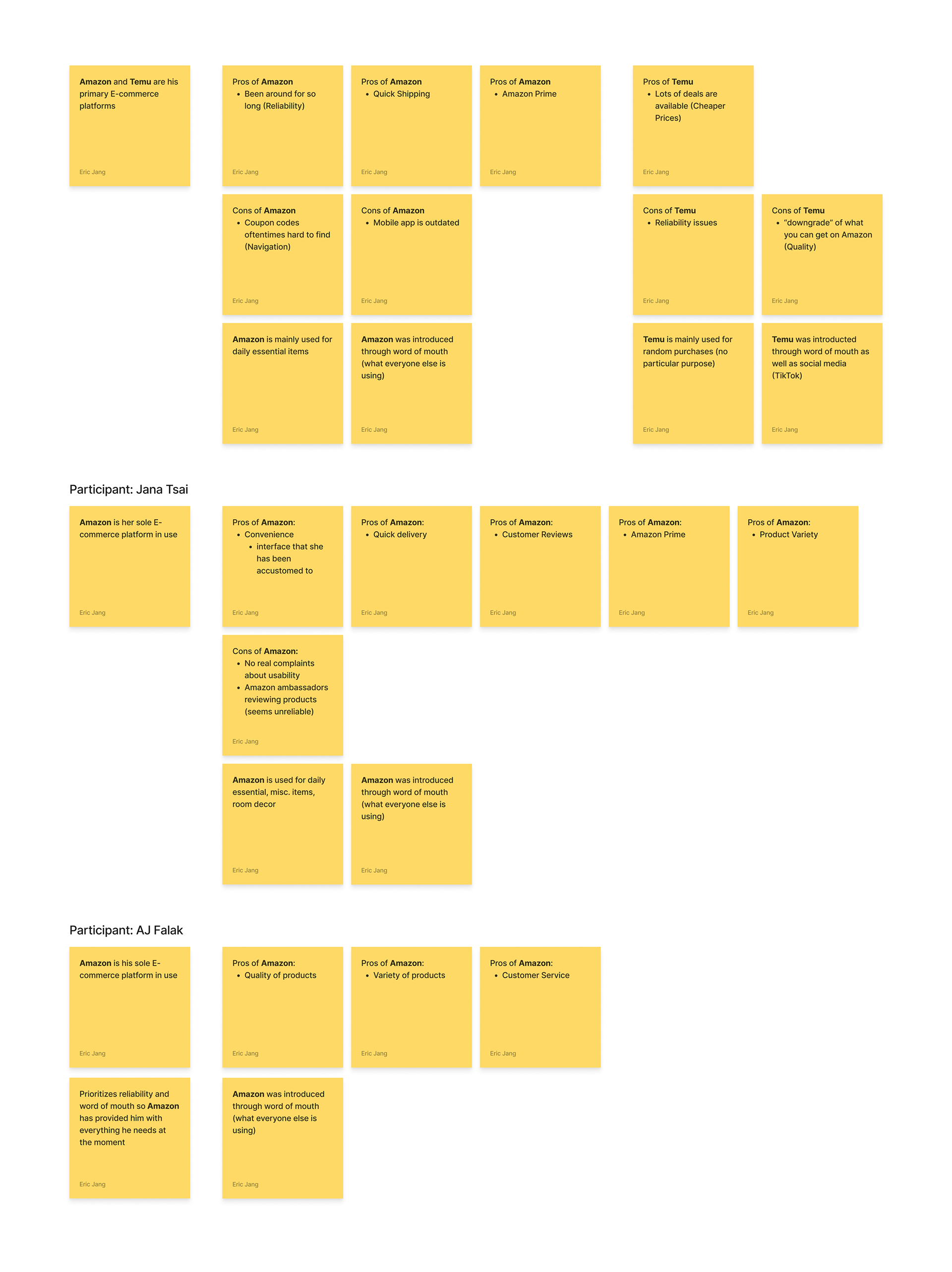

QUALITATIVE DATA ANALYSIS

• My team and I used Figma to outline all of the key points from our user interviews.

• Some consistencies that we noticed were that:

• Users were more inclined to use a platform if it had good-quality products and positive reviews.

• Participants were not too persuaded simply by advertisements and social media presence.

• Most of our interviewees were drawn towards fast shipping and membership opportunities.

• It's crucial for a platform to have a wide range of products without being excessive, as many of our users were overwhelmed with too many options.

USER PERSONAS

• As we noticed some key patterns from our previous methods, we wanted to put them into perspective and highlight our ideal consumer.

• For example, our ideal consumer is someone who is environmentally conscious, prioritizes quality and efficiency, and values variety but not to an extreme.

• Most importantly, it was insightful to have an archetype of our everyday user, such that our stakeholders have a better understanding of our brand values and goals.

USER JOURNEY MAPS

• Following the user personas, the journey maps helped us better visualize the expectations and steps that our users might take on our platform.

• Some patterns I wanted to emphasize that aligned with my colleague's work was that users value quality above other factors and aren't easily persuaded by advertisements alone.

• Our users were more influenced by positive customer reviews, as well as fast and efficient shipping.

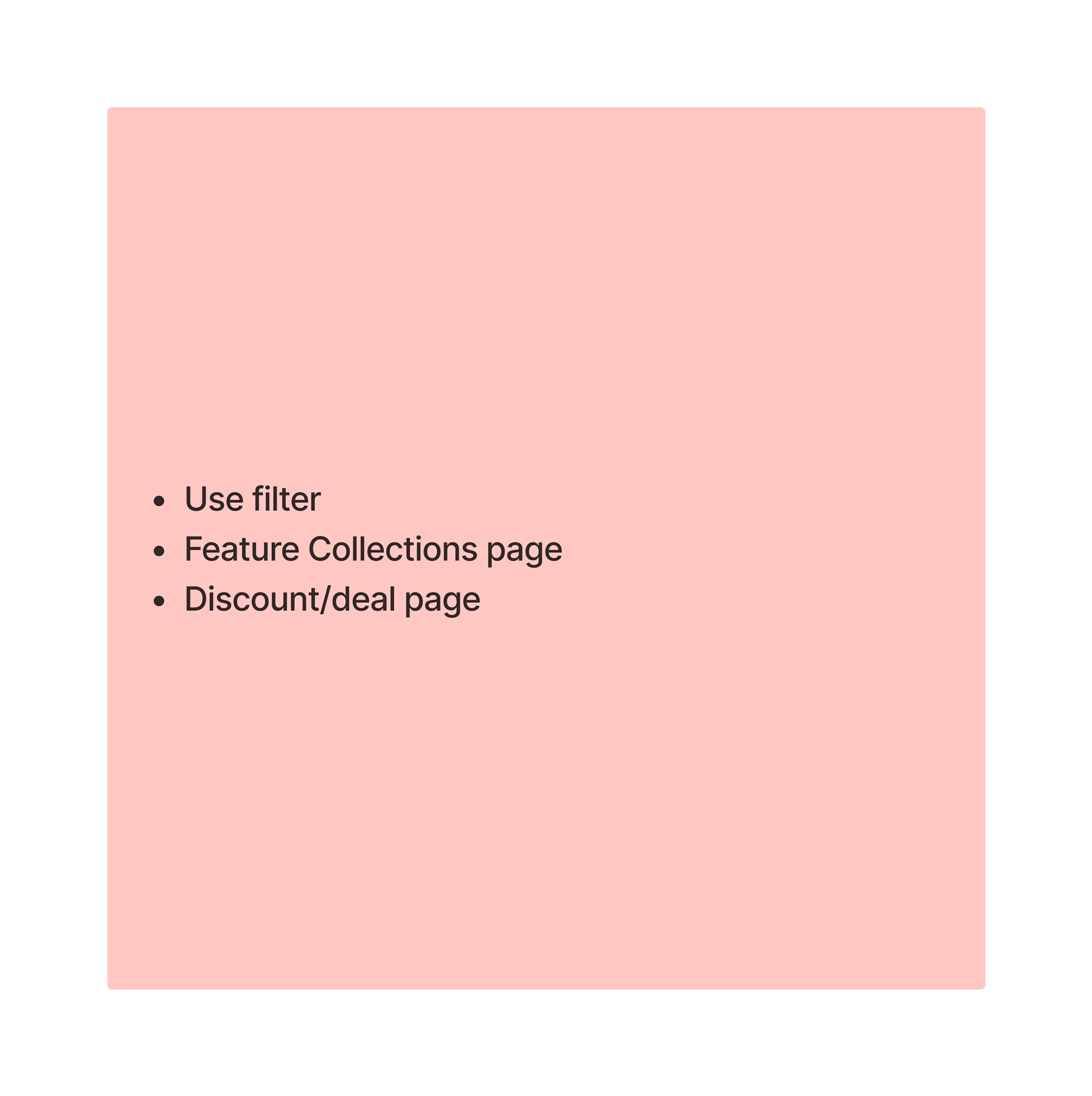

USER FLOWS & RED ROUTES

• User flows helped to better articulate and layout our problem statements, as well as gain more knowledge on user behaviors.

• In conjunction with the user flows, the red routes pointed out all of the consistencies that we noticed with a majority of our users.

• For example, we found that most users valued positive customer reviews, as well as side-by-side comparisons of products.

INFORMATION ARCHITECTURE

• As an e-commerce platform, we had numerous features that were vital to the layout of our design system.

• For example, our product owners mentioned the importance of a wishlist section, as well as different filters for our users.

• Collaborating with developers showed us all of the different buttons that we should include when organizing our ideas.

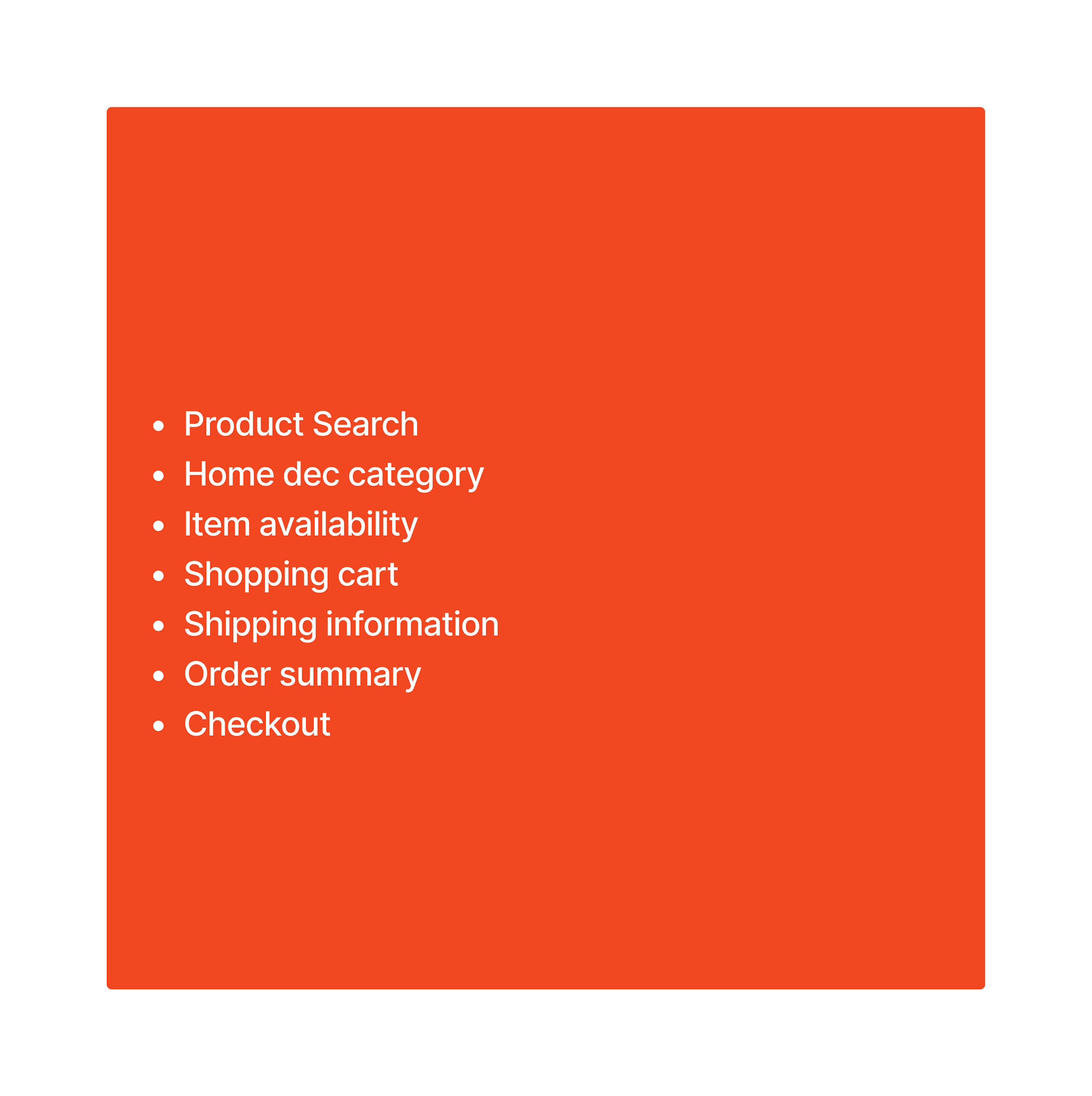

MID-FIDELITY WIREFRAMES

• For our prototype, we wanted to prioritize efficiency and make sure that it was as detail-oriented as possible.

• After receiving feedback from our stakeholders and developers, we had a clear direction for what our homepage would look like.

• For example, we made sure to include many images and highlight the variety of products that our brand offers.

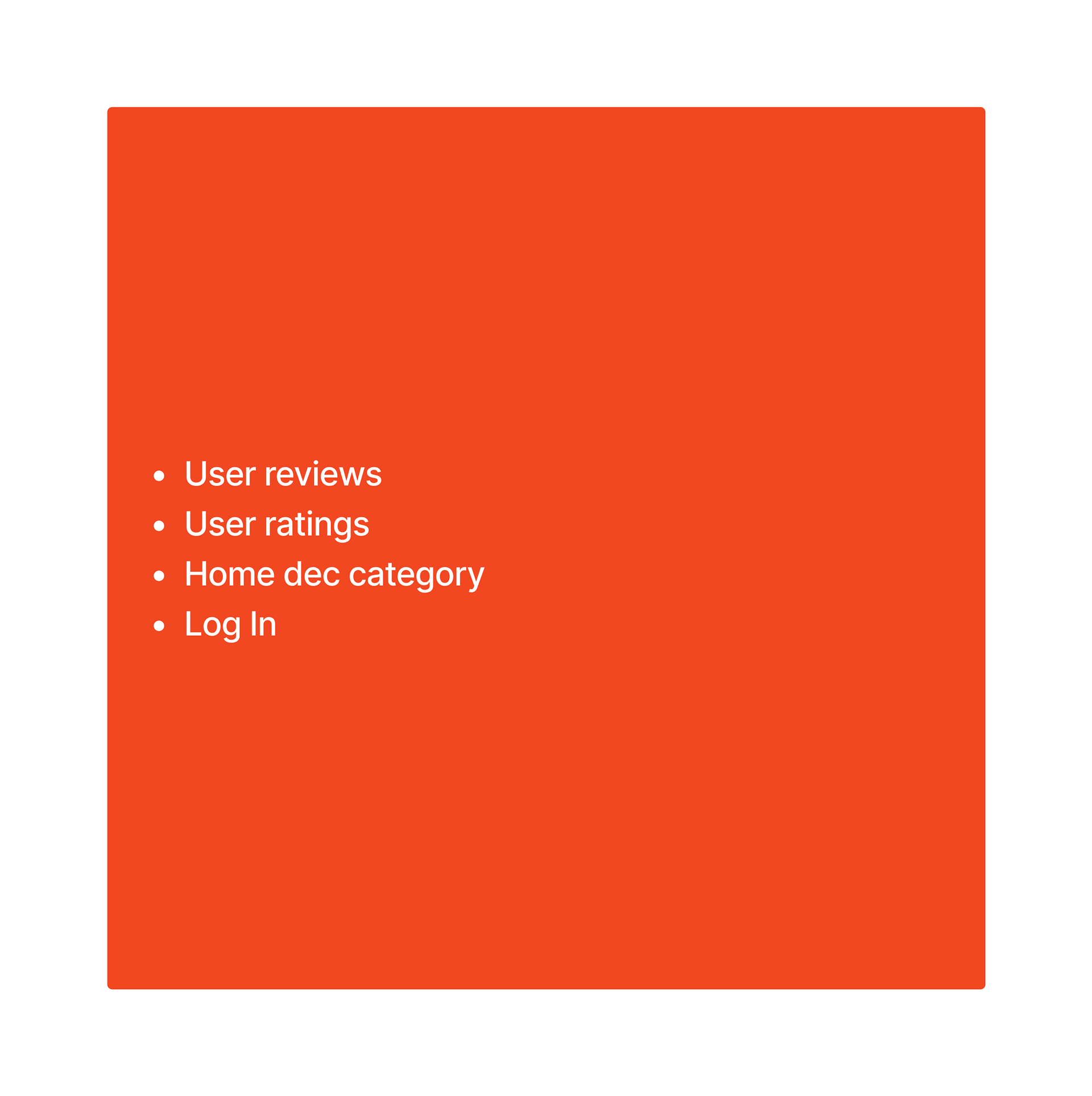

GUERILLA TESTING

• My colleagues and I interviewed 7 participants for the guerilla testing portion of our project.

• The metrics included how quickly interviewees were able to locate certain features, such as the login, checkout, shipping, and search pages.

• My interviewees mentioned how they would've liked to see the number of reviews per product, but enjoyed how the customer ratings page gave the option to include images for their reviews.

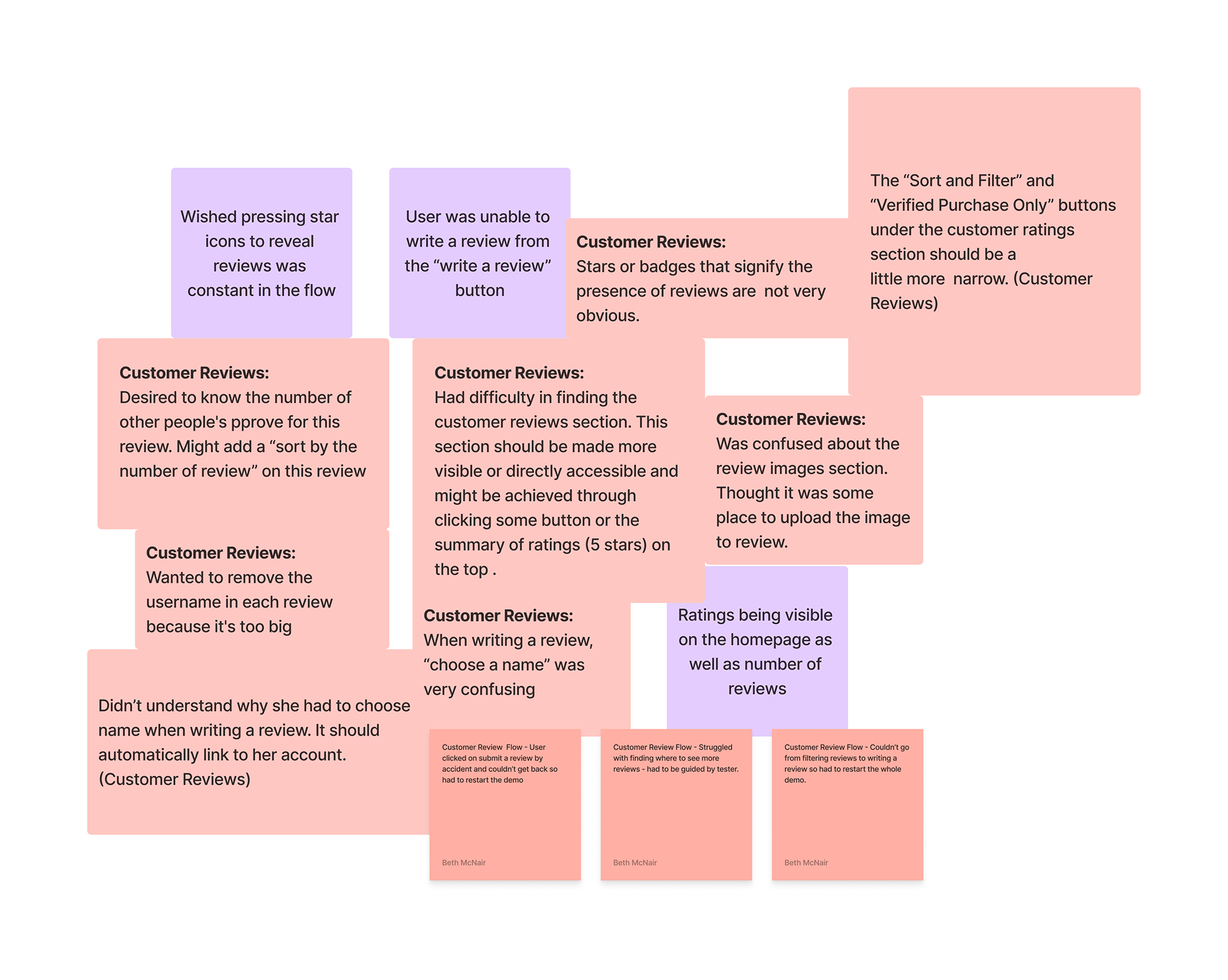

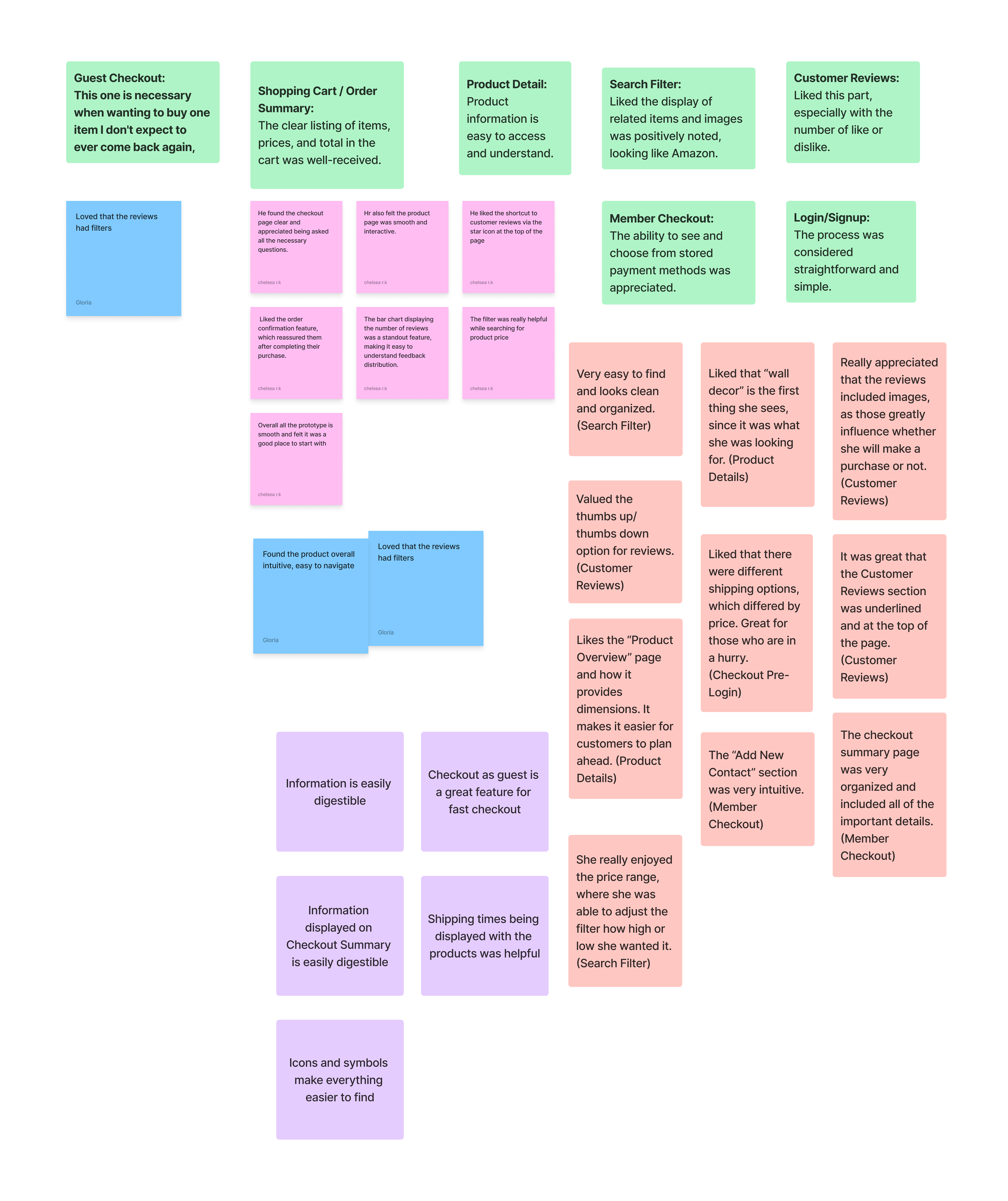

AFFINITY MAPPING

• Common themes that I noticed after completing the interviews were that some our users had trouble locating the customer reviews section.

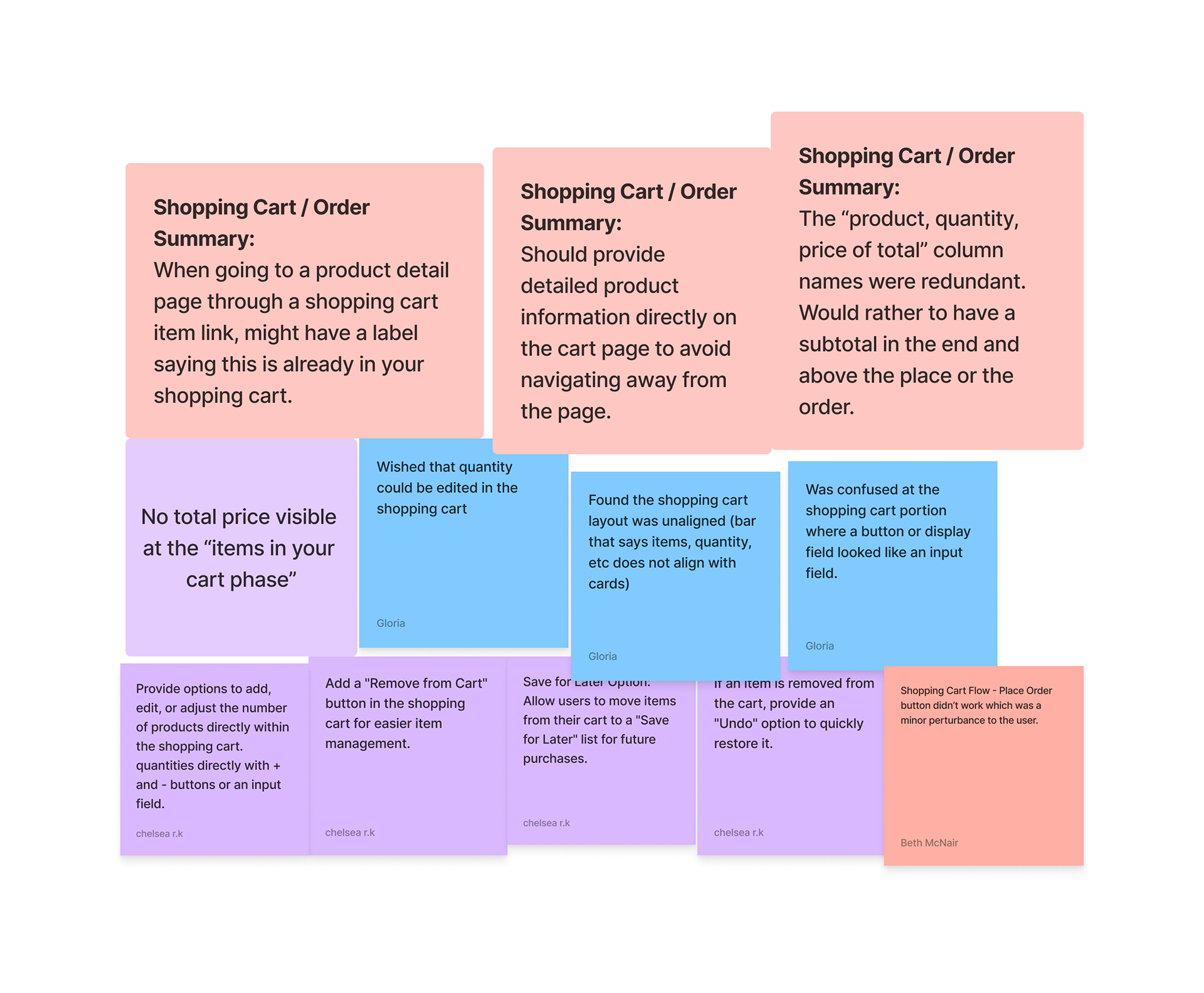

• They wanted the option to add, remove, or adjust the number of items from their cart.

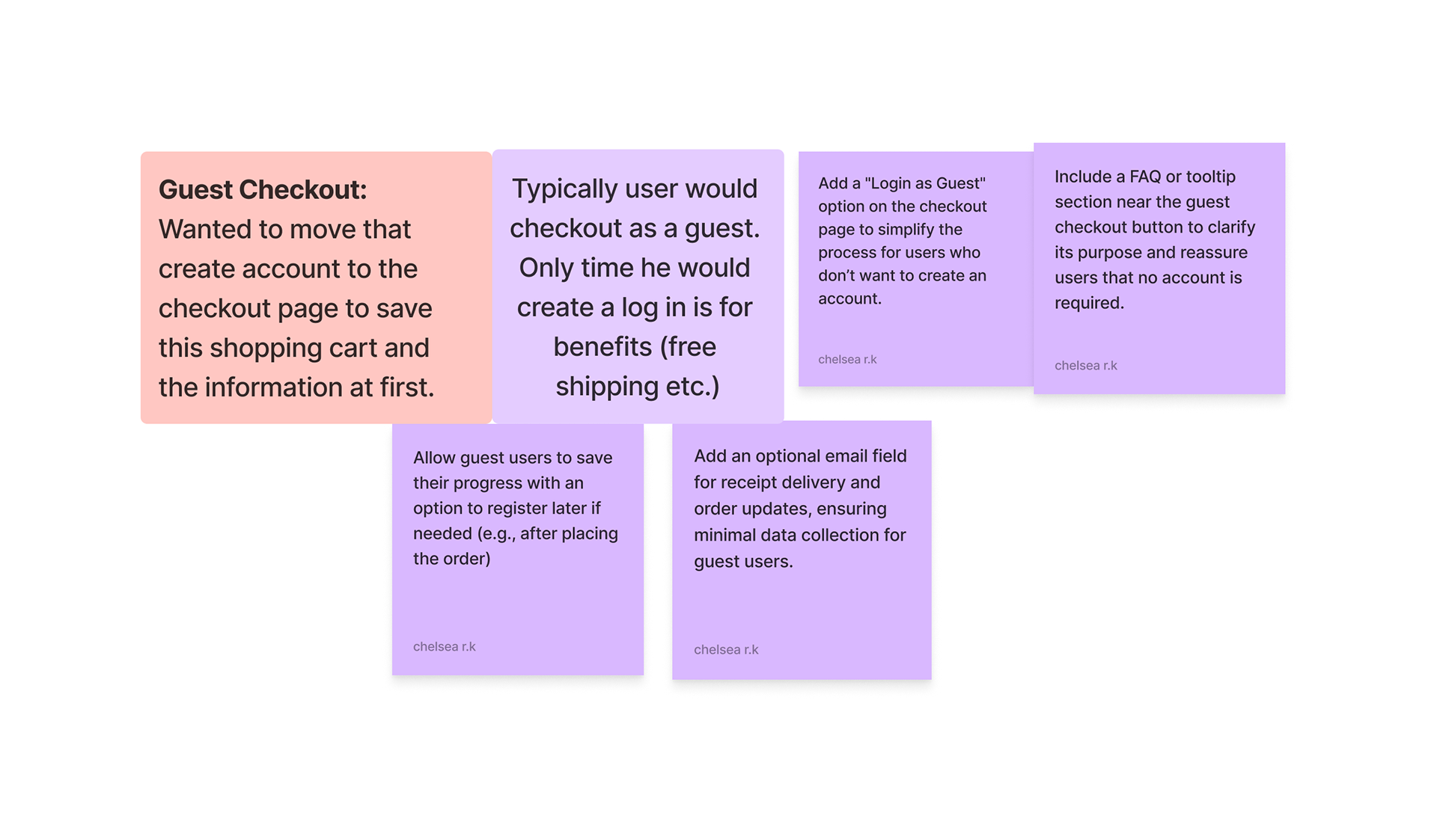

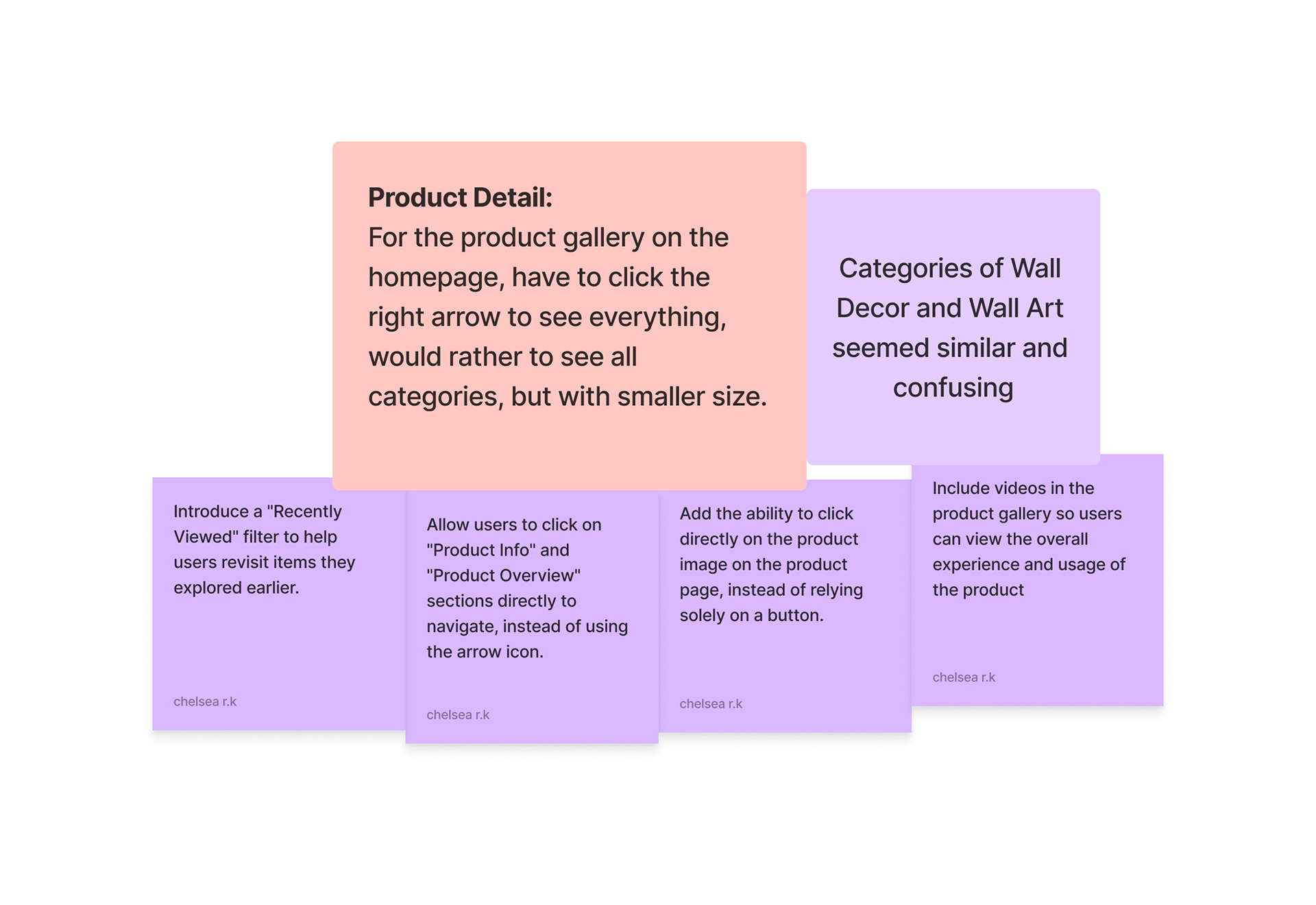

• Participants also felt that the shopping cart page should be more descriptive, so that they don't have to go to the previous page to confirm their information.

KEY TAKEAWAYS

• My team and I wanted to make sure that our data was sharp and informative, so that the next cohort of researchers had a great reference point to work off of.

• We noticed a lot of patterns during our secondary research phases, which further aligned with our survey and interview findings.

• The data that we gathered was integral to understanding our competitors and how we should pivet our marketing and identify target audiences.